In today’s fast-paced digital world, verifying identities securely and efficiently has become a top priority for businesses, especially in banking, fintech, and e-commerce. One of the most reliable solutions available is Digital KYC (Know Your Customer) verification combined with finger scanner online technology. These advanced methods offer a streamlined, secure, and fully remote process for onboarding customers while reducing fraud.

What is Digital KYC Verification?

Digital KYC verification is an electronic process that allows companies to authenticate the identity of individuals using digital documents and real-time verification tools. Unlike traditional paper-based KYC, digital KYC is faster, more secure, and user-friendly. It uses OCR (Optical Character Recognition), facial recognition, and document authentication to verify government-issued IDs such as Aadhaar, PAN, passports, and more.

This automated approach not only minimizes manual errors but also accelerates the customer onboarding process. Businesses can verify a user’s identity in seconds while remaining fully compliant with regulatory requirements.

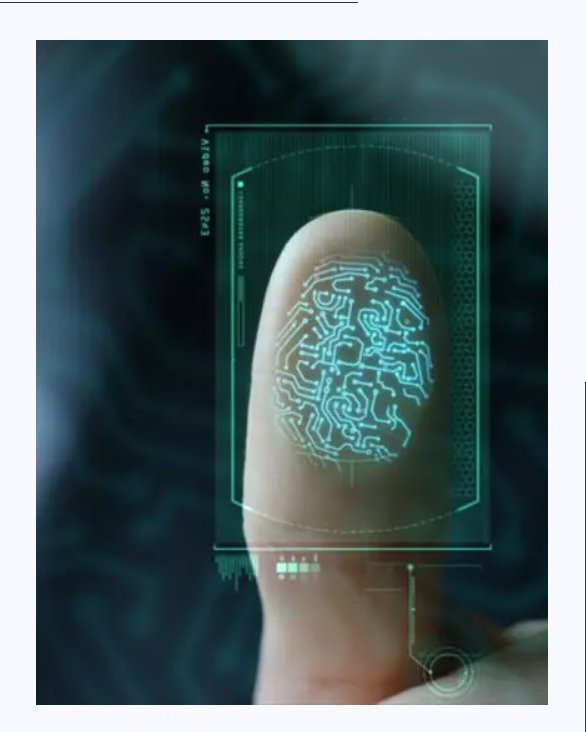

The Role of Finger Scanner Online

Online fingerprint scanners add an extra layer of biometric security to the digital KYC process. These scanners capture unique fingerprint data and match it against stored biometric databases for quick and accurate identity confirmation. This technology is particularly effective in detecting duplicate or fake identities, ensuring that only genuine users gain access to services.

Fingerprint verification is widely used in financial institutions, government services, and telecom sectors. When integrated with digital KYC, it creates a robust verification system that is almost impossible to bypass or manipulate.

Benefits of Digital KYC and Finger Scanner Integration

-

Faster Onboarding: Automates the KYC process, reducing time and improving customer experience.

-

Enhanced Security: Fingerprint authentication makes identity fraud extremely difficult.

-

Remote Verification: Enables secure KYC verification from any location, supporting a mobile-first approach.

-

Regulatory Compliance: Meets global KYC and AML (Anti-Money Laundering) standards.

-

Cost-Effective: Reduces operational costs associated with manual checks and paperwork.

Conclusion

As identity fraud continues to rise, embracing technologies like digital KYC verification and finger scanner online systems is essential. These tools not only improve the accuracy of verification but also offer a seamless experience for users. Businesses looking to stay compliant, secure, and efficient must adopt these modern identity verification solutions to stay ahead in a competitive digital environment.